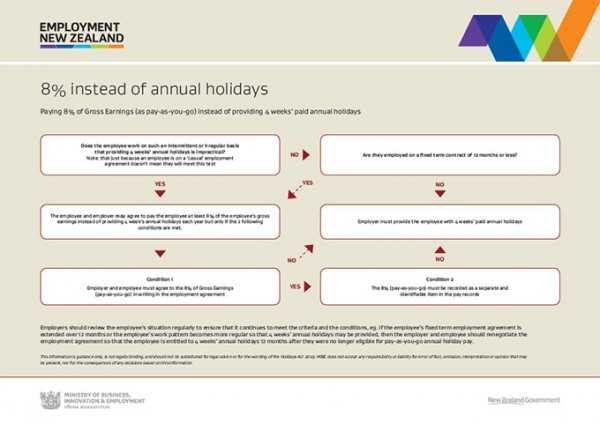

Nz Ird Tax Code Flow Chart

Official page of inland revenue ird nz.

Nz ird tax code flow chart. Write m in the circle under question 2 of the tax code declaration ir330 form and give the completed form to work and income. Make sure you answer questions 1 4 of the ir330. Go to www ird govt nz search keyword. Official page of inland revenue ird nz.

Less or equal to 48 000 your secondary tax code is s and your nz super will be taxed at 17 5 between 48 001 and 70 000 your secondary tax code is sh and your nz super will be taxed at 30 more than 70 000 your secondary tax code is st and your nz super will be taxed at 33. If you need help choosing your tax code go to www ird govt nz or contact us on 0800 227 774. Here to help during office hours 8am 5pm mon fri. Individuals pay progressive tax rates.

Tax codes are different from tax rates. Tax codes only apply to individuals. If you re a non resident contractor the application process is different. Here to help during office hours 8am 5pm mon fri.

Use this form if you are an employee starting a job or changing your tax code. Go to www ird govt nz search keyword. Make sure you answer questions 1 4 of the ir330. For more information go to www ird govt nz search keywords.

Your employer uses your tax code to work out how much tax to take out of your salary or wage. You can apply for a tailored tax rate in myir or by completing a tailored tax code application ir23bs form.