Tax Code Flowchart New Zealand

64 4 978 0767 from a cellphone.

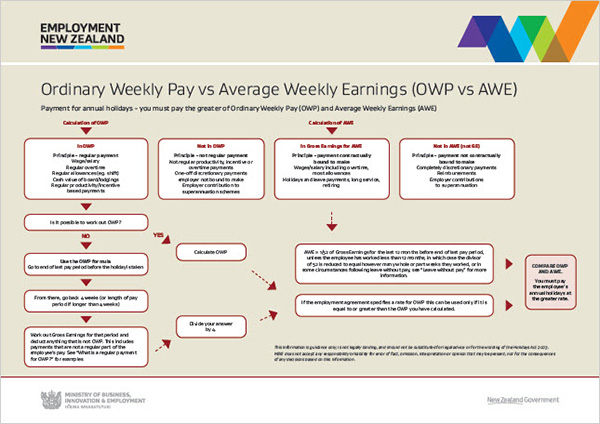

Tax code flowchart new zealand. Ir work out the right amount of tax for you and provide you with a special tax code certificate. Salary or wages a work and income benefit new zealand superannuation veteran s pension a student allowance. You need to work out your tax code for each source of income you receive. Individuals pay progressive tax rates.

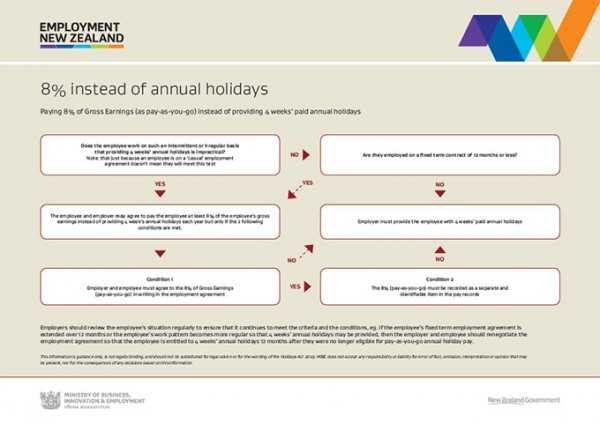

Tax codes only apply to individuals. If your annual income from all sources is between nz 14001 and nz 48000 your tax code is s. They help your employer or payer work out how much tax to deduct before they pay you. You do not receive new zealand superannuation veteran s pension or an overseas equivalent.

Tax codes help your employer or payer work out how much tax to deduct from your pay benefit or pension. 1 ir330c tax rate notification for contractors april 2019 use this form if you re a contractor receiving schedular payments. If you re receiving salary or wages as an employee you ll need to use the tax code declaration ir330 form. Tax rates are used to work out how much tax you need to pay on your total income for the year from all sources.

You and your partner do not receive working for families tax credits or an overseas equivalent. 0800 257 773 from a new zealand landline only. The top rate of tax has remained below 40. If your annual income from all sources is less than nz 14000 your tax code is sb.

2 your tax code. You must complete a separate tax code declaration ir330 for each source of income choose only one tax code refer to the flowchart on page 2 and then enter a tax code here. New zealand tax rates have varied over the past few decades. You are a new zealand tax resident.

You need to declare your tax code to your employer or payer if you get. Currently new zealanders pay 10 5 tax on the first 14 000 of income and a maximum of 33. Tax codes are different from tax rates. If you get schedular payments as a contractor you need to declare your tax rate or show a certificate of exemption to your payer.

This is the lowest overall rate for over twenty years. Tell your employer or payer what your code is otherwise they will tax you at the higher non declaration rate of 45. If you receive schedular payments you will receive an invoice for your acc levies directly from acc. You need to give this to your employer or pension provider.

As a working holidaymaker isnt likely to have a new zealand student loan these are the likely secondary income tax codes. Tax code declaration ir330 schedular payment earners do not use this form if you re a contractor receiving schedular payments use the tax rate notification for contractors ir330c instead. Special tax code application ir23bs.